Understanding Travel Tax with AirAsia: What You Need to Know

Traveling with AirAsia is one of the most affordable ways to explore Asia and beyond. However, when planning your trip, it’s essential to understand the different taxes and fees that may apply to your booking. In this article, we will break down what travel taxes are, how they affect your AirAsia ticket price, and provide helpful tips to ensure a smooth booking experience.

What Is a Travel Tax?

A travel tax is a fee imposed by governments or airports on passengers who are traveling internationally or domestically. These taxes are typically included in the cost of your ticket but can vary depending on the destination, airport, and type of travel.

For example, when flying with AirAsia, the price of your ticket might appear to be low initially, but additional travel taxes are added on top of the base fare. These taxes often cover services such as airport maintenance, security measures, and governmental regulations related to air travel.

Types of Travel Taxes on AirAsia Flights

AirAsia operates across many countries, and as such, the types of taxes you encounter can differ based on your departure and arrival locations. Below are some common travel taxes you should be aware of:

- Airport Tax: A mandatory fee collected by the airport authority for the use of airport facilities and services.

- Passenger Service Charge (PSC): This fee covers the cost of security, check-in, and other passenger services.

- Fuel Surcharge: An additional fee related to the fluctuating cost of fuel.

- Government Tax: Some countries impose taxes on international flights, including Value Added Tax (VAT) or Tourism Tax.

- Tourism Tax: Applied by some countries, this tax is meant to fund tourism development and infrastructure.

It’s important to note that these taxes can be included in the total price of your ticket or charged separately during the booking process.

How Are Travel Taxes Calculated on AirAsia?

AirAsia calculates travel taxes based on several factors, including:

- Departure and Arrival Locations: Taxes vary depending on which countries or regions you are traveling to or from. Each country has its own regulations and tax rates.

- Type of Flight: International flights often have higher taxes compared to domestic flights due to the additional services required.

- Airports Used: Some airports charge higher taxes, especially major international hubs, due to their infrastructure and security requirements.

When booking your ticket on AirAsia’s website, the travel taxes and fees will be clearly outlined before you finalize your purchase. However, the base fare shown on initial searches typically excludes these additional costs.

Common Travel Taxes You May Encounter with AirAsia

1. Domestic Taxes (Within the Same Country)

When flying domestically with AirAsia, the taxes tend to be relatively low. These fees usually include:

- Airport Taxes: Collected by local airports for operating costs and facilities.

- Government Taxes: Small charges that contribute to domestic aviation regulations.

These taxes are generally included in the final ticket price, but always double-check when booking.

2. International Travel Taxes

For international flights, AirAsia’s travel tax structure includes various international charges, including:

- International Passenger Service Charges (IPSC): This tax is imposed when flying internationally and can vary significantly depending on the country of departure and destination.

- Departure Taxes: Some countries impose specific taxes on passengers leaving the country. For instance, Malaysia’s Departure Tax is imposed on all international passengers.

Remember, these international taxes can be substantial, so it’s always good to check the full breakdown during booking.

AirAsia Travel Tax Refunds

Occasionally, passengers may be eligible for a tax refund on certain tickets, especially in the case of cancellations or delays. AirAsia allows customers to request refunds for unused travel taxes under certain circumstances.

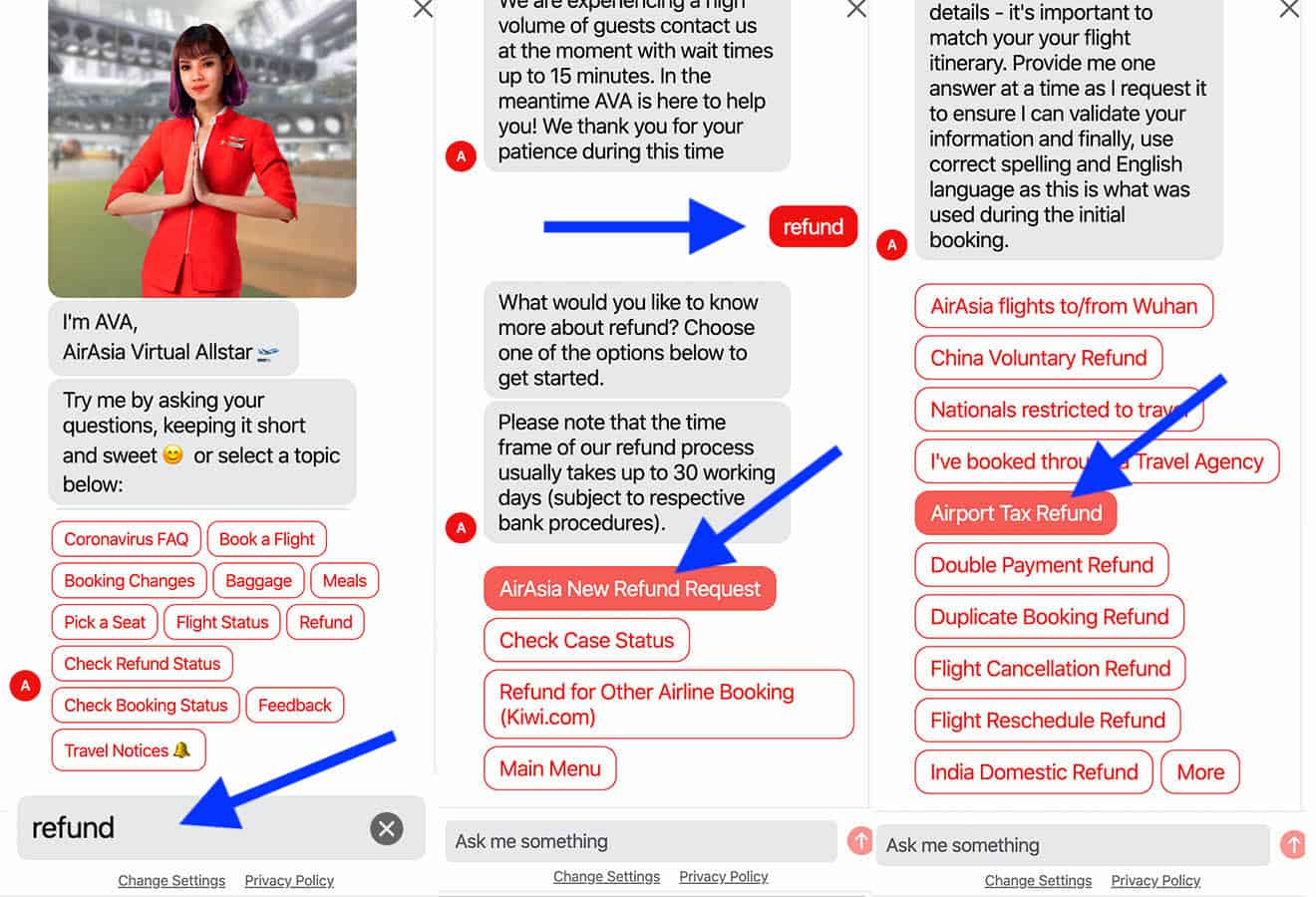

If your AirAsia flight is canceled or significantly delayed, you may be eligible for a refund of taxes paid. To initiate the process, follow these steps:

- Log into your AirAsia account.

- Go to the ‘Manage My Booking’ section.

- Select the flight you want to cancel or request a refund for.

- Complete the necessary forms for a refund.

Note that refund eligibility depends on specific rules and the destination. Some taxes, like tourism taxes, are non-refundable.

Travel Tax Examples by Country for AirAsia Flights

Here are a few examples of the travel taxes you might encounter on AirAsia flights, depending on where you’re flying to or from:

- Thailand: Known for its Passenger Service Charge (PSC), Thailand adds this tax on both domestic and international flights. The rates can vary by airport.

- Indonesia: Airport taxes are significant for international flights, with international service charges added on top of the ticket price.

- Malaysia: When departing from Kuala Lumpur International Airport, you will encounter Malaysia’s departure tax, which differs based on whether the flight is international or domestic.

For a more detailed list of taxes for specific countries and airports, you can visit AirAsia’s official travel tax information page.

FAQs About AirAsia Travel Taxes

1. Why are travel taxes not included in the base fare?

Travel taxes are government-imposed fees, and airlines like AirAsia are required to collect them separately. They are calculated and added on top of the base fare to ensure transparency.

2. Can I get a refund on my travel taxes?

In some cases, yes. If your flight is canceled or delayed, you may be eligible for a refund of certain taxes. However, some taxes, such as tourism taxes, are usually non-refundable.

3. How can I avoid unexpected travel taxes?

While you can’t avoid taxes entirely, you can check the full breakdown of your ticket price before confirming your booking on AirAsia’s website. This will give you a clear idea of the additional taxes and fees.

4. Are travel taxes included in the AirAsia app?

Yes, the AirAsia mobile app will display a complete breakdown of your ticket price, including any taxes and additional fees before you make your payment.

Final Thoughts on AirAsia Travel Taxes

Understanding AirAsia travel taxes is essential when booking a flight with the airline. While the base fare may seem affordable, it’s important to account for the additional taxes that will be added during the booking process. These taxes vary depending on your destination, flight type, and airport, so always check the details before confirming your ticket.

Being aware of travel taxes helps you avoid surprises and plan your budget accordingly. While some taxes may be refundable in certain situations, it’s always a good idea to understand the terms and conditions related to refunds before purchasing.

If you’re planning your next adventure with AirAsia, be sure to check the breakdown of airport taxes, fuel surcharges, and government taxes so you can travel without any unexpected costs!